Introduction

As Meta Platforms (formerly Facebook) continues to see significant growth in its stock price, speculation about a potential stock split in 2024 has gained momentum. This blog delves into the reasons behind the speculation, the benefits of a stock split, and what investors can expect.

Recent Performance and Market Trends

Meta Platforms has experienced remarkable growth over the past year, with its stock price surging by 175%. Currently trading near $500 per share, the company’s market capitalization has reached approximately $1.2 trillion. This substantial increase in stock value makes Meta a prime candidate for a stock split, similar to other tech giants like Amazon, Tesla, and Alphabet, which have implemented splits to make their shares more accessible to retail investors (The Motley Fool) (Barchart.com).

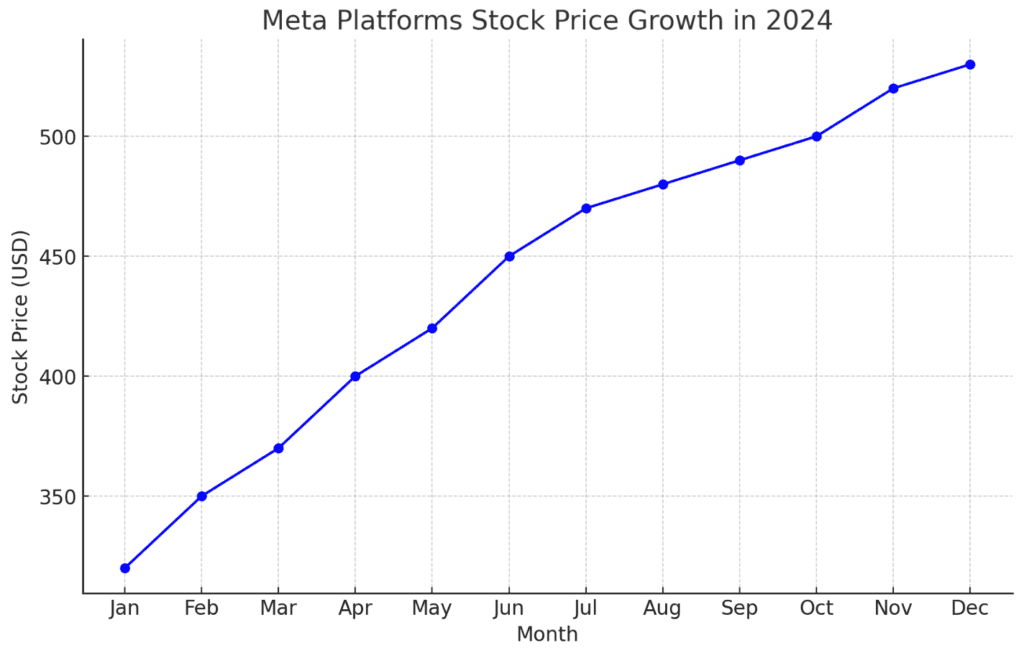

Meta Platforms Stock Price Growth in 2024

| Month | Stock Price (USD) |

|---|---|

| Jan | 320 |

| Feb | 350 |

| Mar | 370 |

| Apr | 400 |

| May | 420 |

| Jun | 450 |

| Jul | 470 |

| Aug | 480 |

| Sep | 490 |

| Oct | 500 |

| Nov | 520 |

| Dec | 530 |

Why Consider a Stock Split?

Stock splits do not change the intrinsic value of a company but can have several benefits:

- Accessibility: By reducing the price per share, a stock split makes the shares more affordable for individual investors. This can increase the stock’s liquidity and broaden the shareholder base.

- Market Perception: Stock splits are often perceived positively in the market, signaling that the company expects continued growth. This can boost investor confidence and potentially lead to a short-term increase in stock price.

- Index Inclusion: Lower-priced shares may become more attractive for inclusion in major stock indices, which can drive additional investment from index funds.

Historical Context and Speculation

Meta Platforms has never split its stock since going public in 2012. However, the current high price and recent performance have led many analysts to speculate that a split could be on the horizon. Ken Mahoney, president of Mahoney Asset Management, mentioned that Meta is “ripe for a split” given its significant price increase and current trading levels (The Motley Fool).

Potential Impact on Investors

A stock split could have several implications for investors:

- Increased Liquidity: More shares available at a lower price can enhance trading volume and liquidity.

- Broader Ownership: Lower share prices can attract a wider range of investors, including those who may have been priced out previously.

- Market Dynamics: Historically, stocks that split often see a short-term boost in price due to increased investor interest and perceived growth prospects.

Conclusion

While there is no official announcement from Meta Platforms regarding a stock split in 2024, the company’s recent performance and market trends suggest that it is a possibility worth considering. Investors should stay tuned to official communications from Meta and market analyses for further updates.